modified business tax return instructions

Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter. BUSINESS TAX GENERAL BUSINESS.

Sign Online button or tick the preview image of the blank.

. Exceptions to this are employers of exempt organizations and employers with household employees only. Download the Individual tax return instructions 2022 NAT 71050 PDF 165MB This link will download a file. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU.

On the S portions Form 8960 worksheet enter the S portions net investment income on line 7 of the trusts Form 8960 and combine line 19a of the Form 8960 worksheet with the non-S portions AGI to arrive at the amount on line 19a. File an amended return on Form 1120x by sending the return along with any schedules that changed to the address where you filed your original corporate tax return. Abbreviations for names and technical terms each term is spelt out the first time it is used.

Keystone Opportunity Zone KOZ Forms. Include a copy of the original return 2. If you are using Chrome Firefox or Safari do NOT open tax forms directly from your browser.

Use the Individual tax return instructions 2022 to work through. Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter. See Regulations section 11411-3 c for more details and examples.

Click the Allow button. The IRS Amended Return process requires that any e-filed return designated as an Amended Return pass all of the same business rules as an original e-filed business return. When we say you or your business in these instructions we mean either you as a business.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU. On line 10 enter Tradersee attached in column a and the totals from the statement in columns d f and g. When we say you or your business in these instructions we mean either you as.

Separately show and identify securities or commodities held and marked to market at the end of the year. How to get a copy of these instructions. BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line.

The advanced tools of the editor will lead you through the editable PDF template. Signature Date 1 to 10 11 to 15 16 to 20 21 to 30 31 15. Motor and Alternative Fuel Tax Forms.

Instructions to complete the return contains information about how to complete each label on the company tax return including company information items 130 the calculation statement and declaration. Endobj 3 0 obj Type Page MediaBox 0 0 612 792 Parent 1 0 R Resources ProcSet PDF Text ColorSpace 6 0 R ExtGState 9 0 R Font 11 0 R Contents 33 0 R endobj 4 0 obj Type Page MediaBox 0 0 612 792 Parent 1 0 R Resources ProcSet PDF Text ColorSpace 34 0 R ExtGState 35 0 R Font 36 0 R Contents 79 0 R. How you can complete the Nevada modified business tax return form on the web.

Enter corrected figures in black ink next to or above the lined-through figures. Malt Beverage and Liquor Tax Forms. MODIFIED BUSINESS TAX Commerce Tax An employer pursuant to NRS 363A and NRS 363B is entitled to subtract from the calculated Modified Business tax a credit in the amount equal to 50 of the amount of the commerce tax paid by the employer.

The modified business tax covers total gross wages less employee health care benefits paid by the employer. The maximum section 179 deduction limitation for 2021. Medical Marijuana Tax Forms.

Modified Business Tax NRS 463370 Gaming License Fees. Re-open the form from your saved location with Adobe Reader or Excel. To get started on the blank use the Fill camp.

For purposes of the PTC household income is the modified adjusted gross income modified AGI of you and your spouse if filing a joint return see Line 2a later plus the modified AGI of each individual whom you claim as a dependent and who is required to file an income tax return because his or her income meets the income tax return filing threshold see Line 2b later. Enter the amount from line 1 here and on Form 4562 line 2. You can find this address on page 3 of the instructions for Form 1120.

Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter Line 2a. Maximum threshold cost of section 179 property before reduction in limitation calculation. Enter your official contact and identification details.

A taxpayer filing an amended return must indicate the return is such by selecting the Amended Return checkbox designation in the software or the return will reject as a duplicate filing. To get a copy of the instructions you can. Place an order to receive it by post or email using our publication ordering service.

CARRY FORWARD If Line 5 is less than zero 0 enter amount FEIN of Business Name Above THIS RETURN MUST BE SIGNED FOR DEPARTMENT USE ONLY PERIOD ENDING. Modified Business Tax. Other Tobacco Products Tax Forms.

Right click on the form icon then select SAVE TARGET ASSAVE LINK AS and save to your computer. To access the website click Allow. Attach to your tax return a statement using the same format as line 10 showing the details of each transaction.

Write the word AMENDED in black ink in the upper right-hand corner of the return. The credit may only be used for any of the four calendar quarters immediately. Line-through the original figures in black ink leaving original figures legible.

PREVIOUS DEBITS Outstanding liabilities AMOUNT PAID 17. Enter the smaller of line 1 or line 2 here. Enter the amount from line 3 here and on Form 4562 line 1.

Instructions contains information about how to complete each label on the company tax return including company information Items 130 the calculation statement and declaration. MODIFIED BUSINESS TAX RETURN 1. Abbreviations for names and technical terms each term is spelt out the first time it is used.

How To Add A Business Location Instructions

3 11 3 Individual Income Tax Returns Internal Revenue Service

Tax Time 10 Most Common Irs Forms Explained

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 12 16 Corporate Income Tax Returns Internal Revenue Service

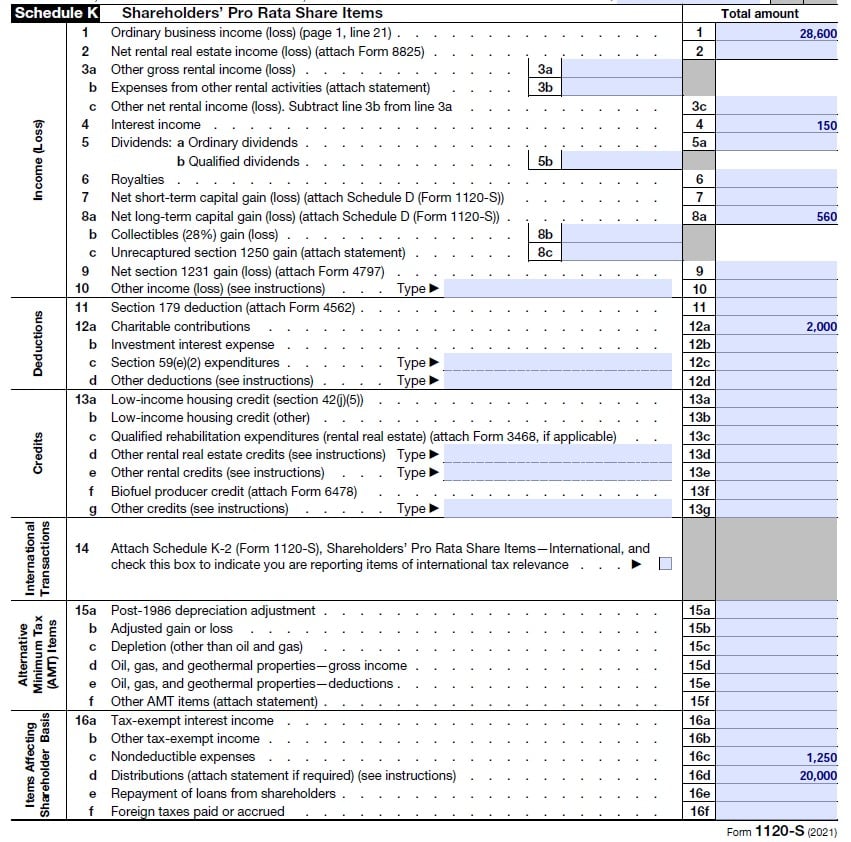

How To Complete Form 1120s Schedule K 1 With Sample

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service